How to Verify Pocket Option Account

User data verification is a compulsory process aligned with the stipulations of the KYC (Know Your Customer) policy and global anti-money laundering regulations (Anti Money Laundering).

In our brokerage role, we must verify user identities, confirm residential addresses, and validate email addresses as part of our user identification process.

Email Address Verification

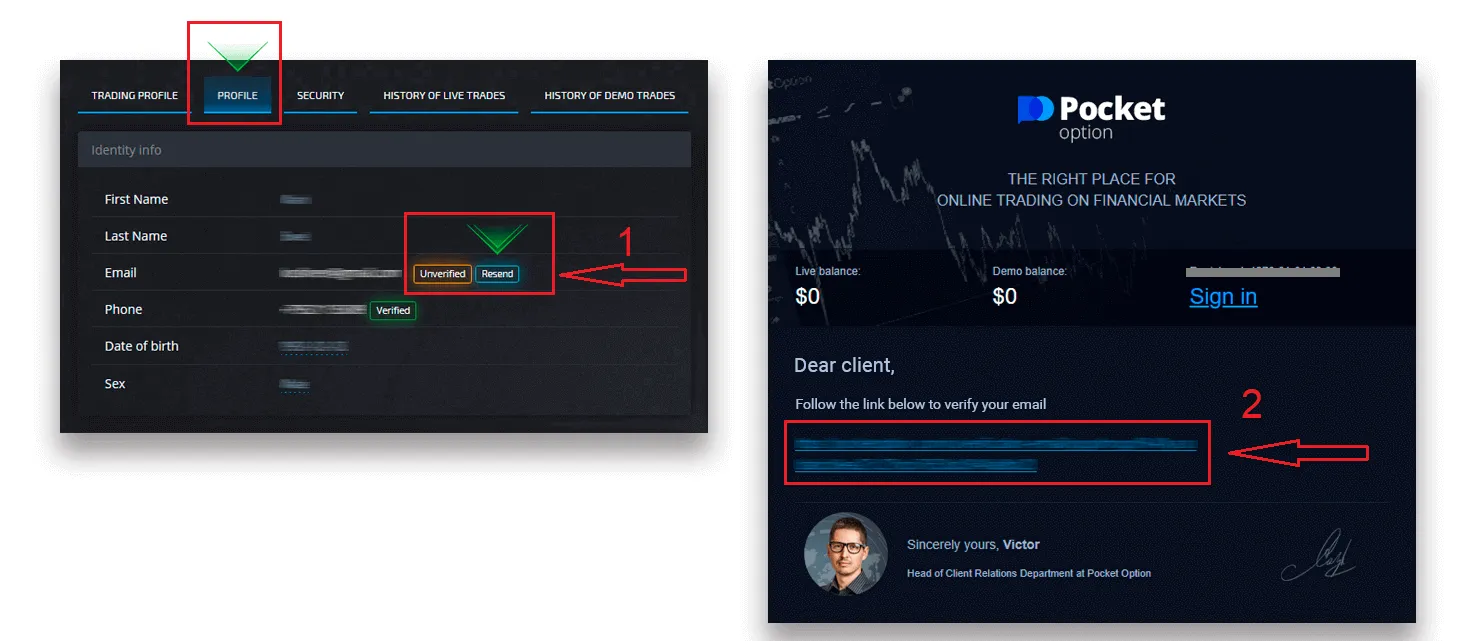

Upon registration, an email confirmation will be sent to you from Pocket Option. Inside this email, you will find a link that must be clicked to verify your email address.

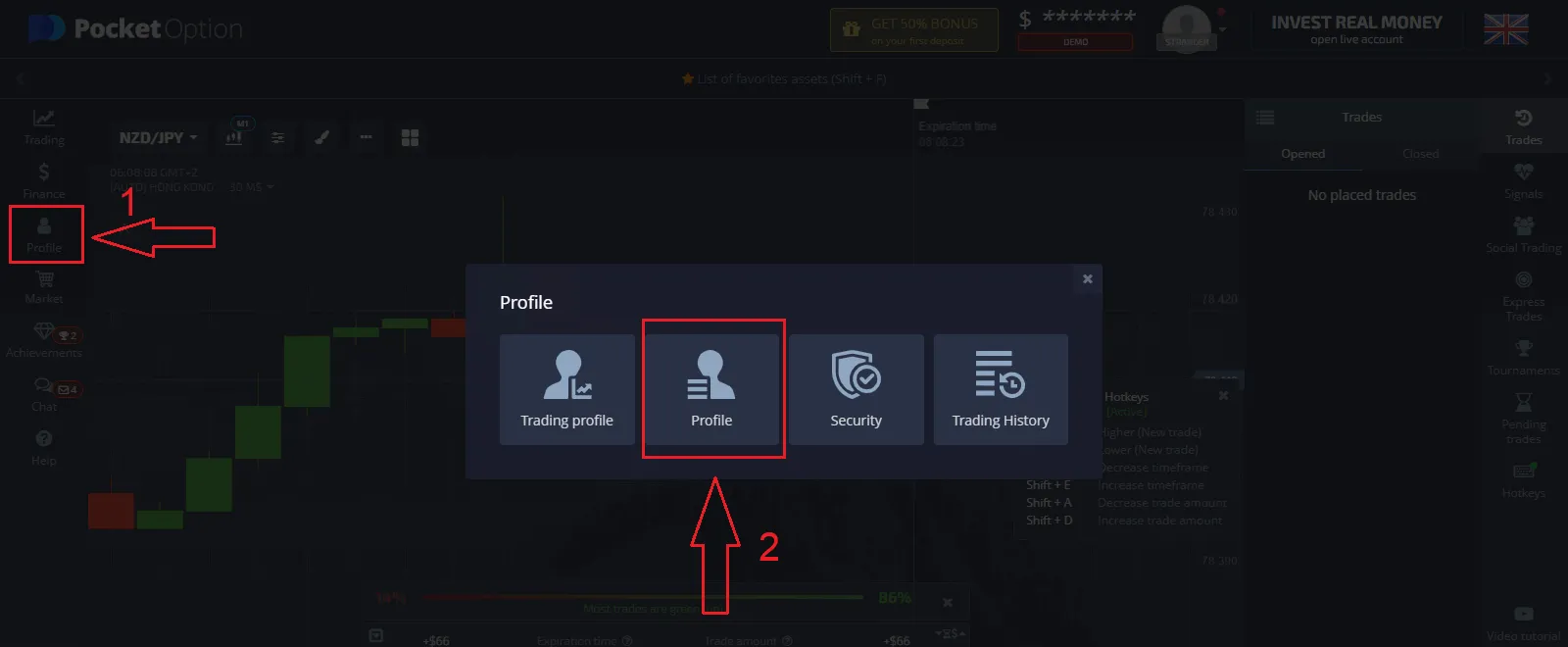

If you do not receive the email promptly, please access your Profile by clicking on “Profile” and then selecting “PROFILE.”

Additionally, within the “Identity info” section, locate and click on the “Resend” button to initiate the sending of another confirmation email.

If you do not receive any confirmation email from us at all, please send a message to support@pocketoptiontrade.com using the email address you registered on the platform with, and we will manually confirm your email for you.

Identity verification

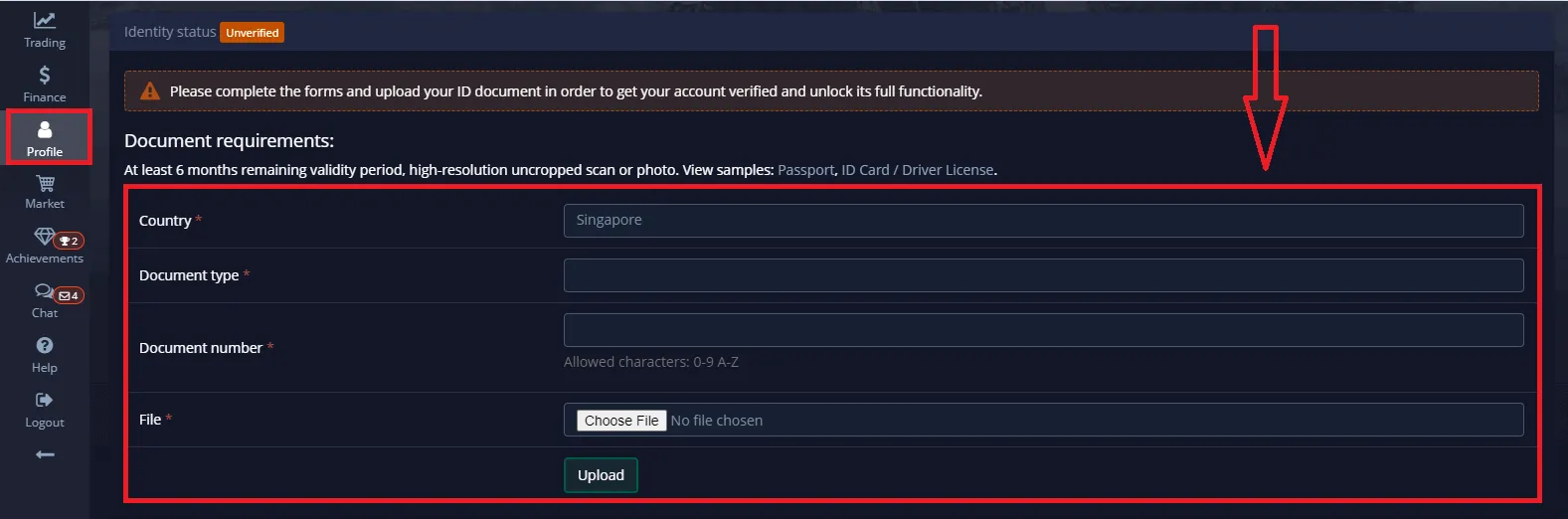

The verification process initiates once you’ve entered your Identity and Address details in your Profile and have uploaded the necessary documents.

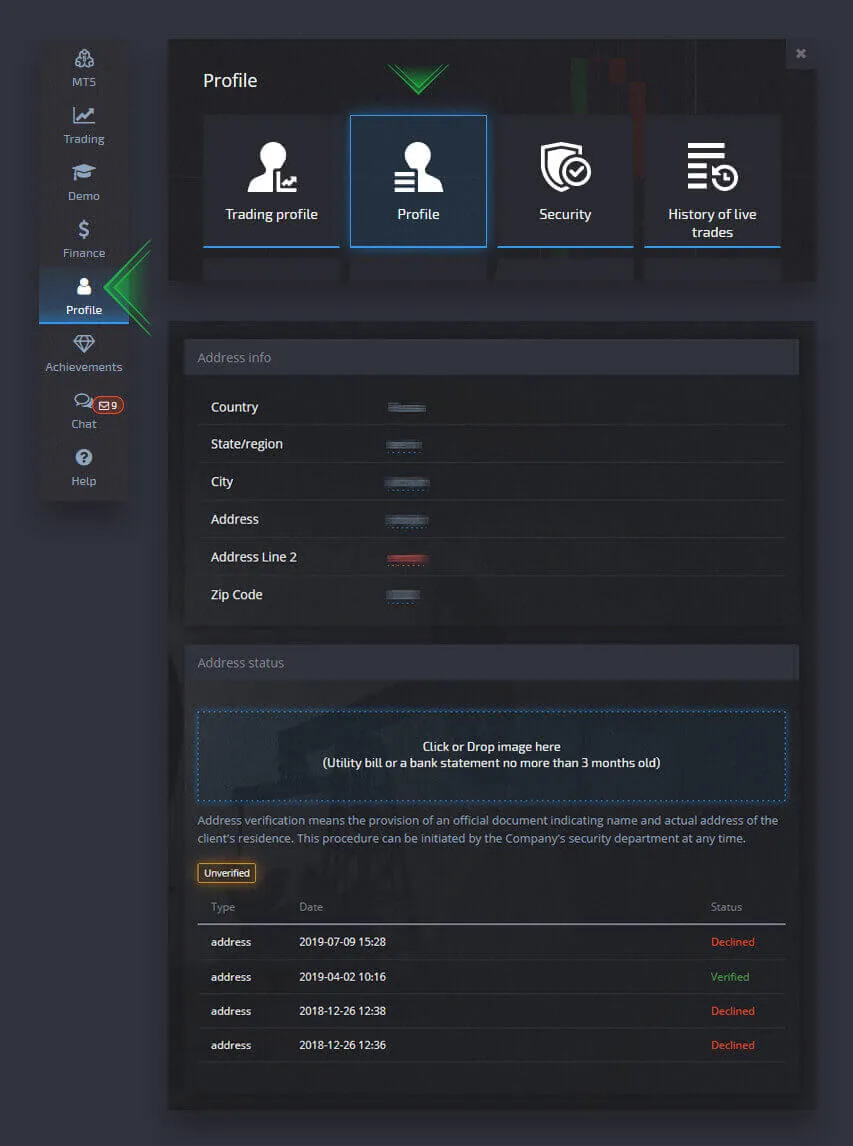

Access the Profile page and locate the sections labeled Identity Status and Address Status.

Attention: Please note, you need to enter all the personal and address information in the Identity status and Address status sections prior to uploading documents.

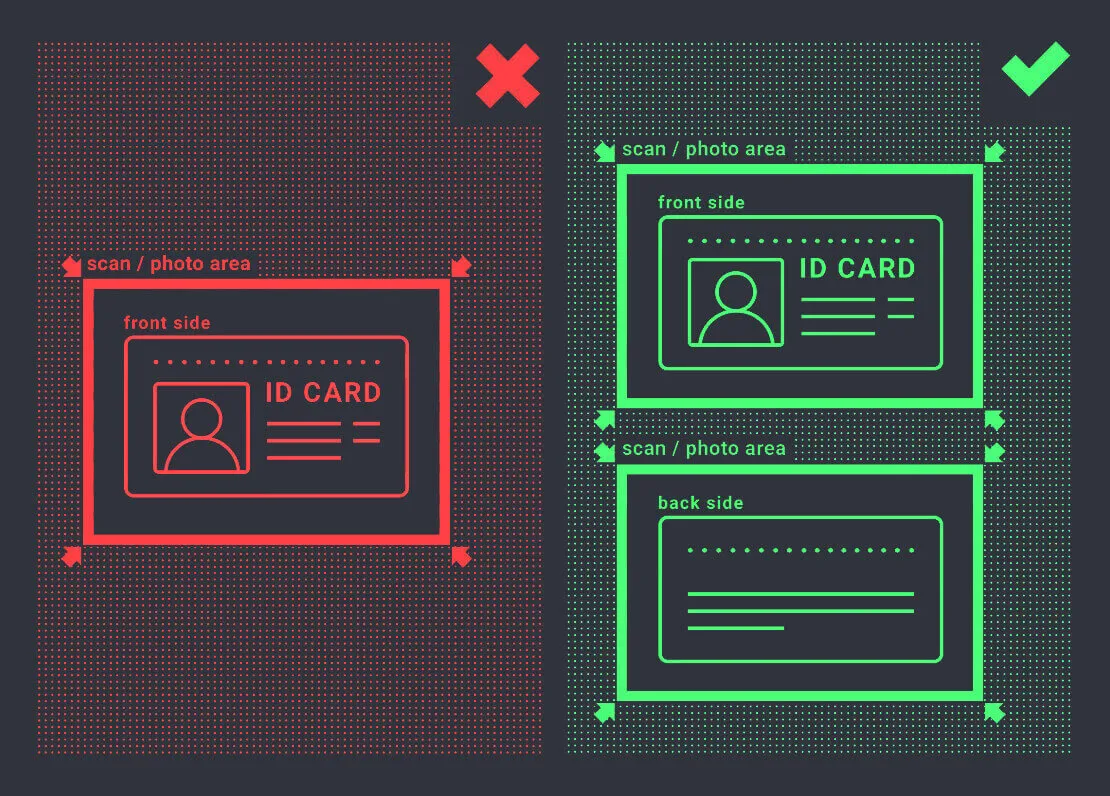

For identity verification, we accept scanned or photographed images of passports, local ID cards (both sides), and driver’s licenses (both sides). You can easily add these images by clicking or dragging them into the respective sections of your profile.

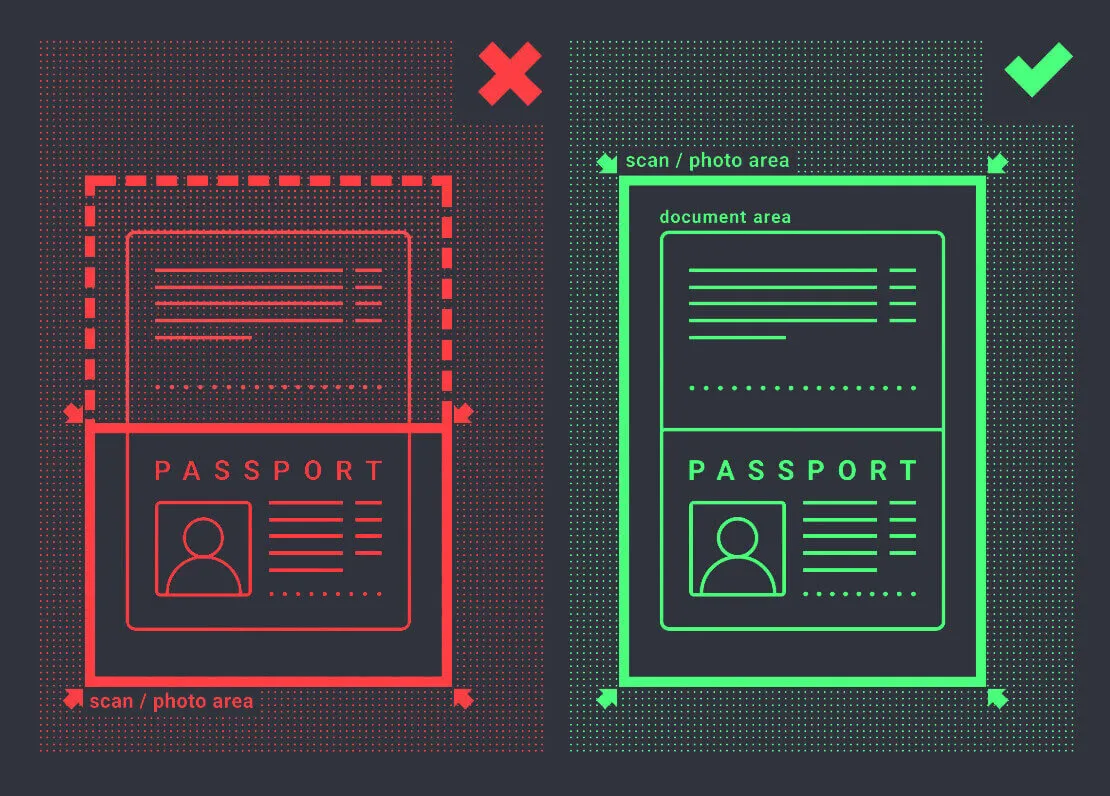

Ensure that the document image is in color, uncropped (with all edges fully visible), and in high resolution (to ensure all information is clearly legible).

Example:

Once you’ve uploaded the images, a verification request will be automatically generated. You can track the progress of your verification in the designated support ticket, where one of our specialists will provide updates and assist you through the process.

Address Verification

The verification process commences after you have completed the Identity and Address sections in your Profile and have uploaded the necessary documents.

To get started, navigate to your Profile page and locate the sections labeled “Identity Status” and “Address Status.”

Please be aware that it is essential to input all personal and address information in the “Identity Status” and “Address Status” sections before proceeding with document uploads.

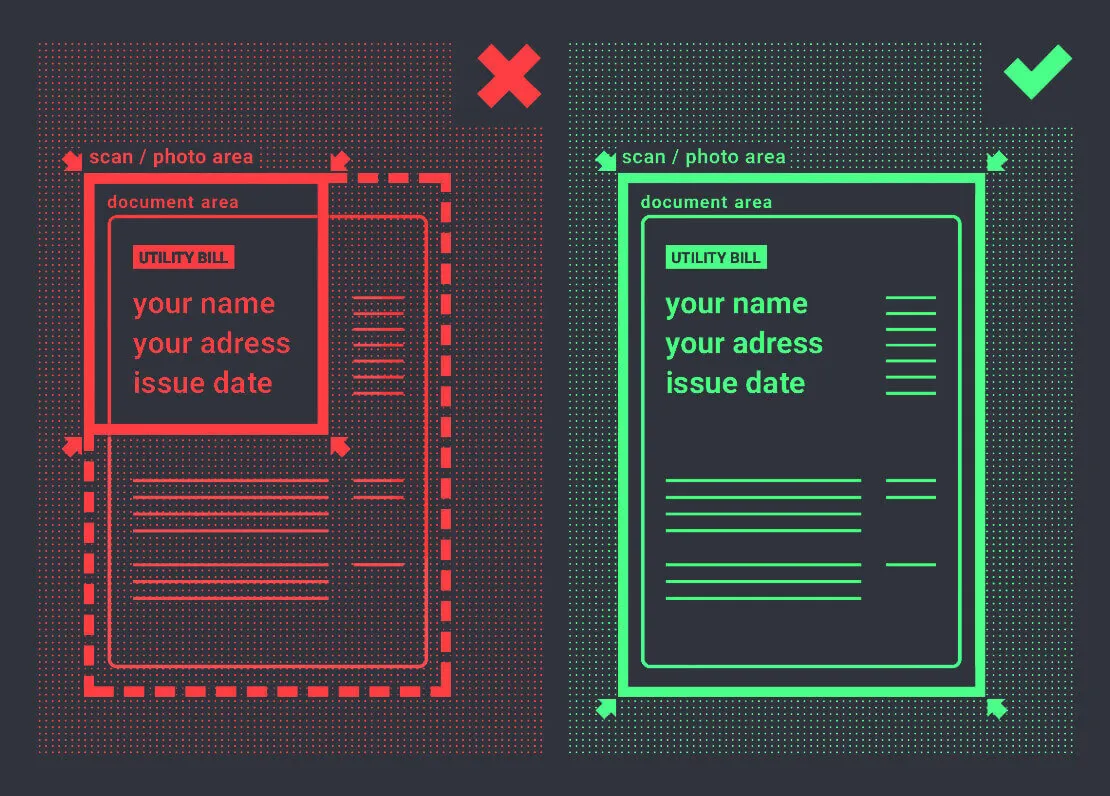

Make sure to fill out all fields (except “address line 2,” which is optional). For address verification, we require a paper-issued proof of address document issued in the account holder’s name and showing an address no older than 3 months (examples include a utility bill, bank statement, or address certificate). You can easily add these document images by clicking or dragging them into the corresponding sections of your profile.

Ensure that the document image is in color, high-resolution, and uncropped (all edges of the document should be clearly visible without cropping).

Example:

Once you’ve uploaded the images, a verification request will be automatically generated. You can monitor the progress of your verification in the designated support ticket, where a specialist will provide updates and assistance.

Bank card verification

Card Verification Procedure for Withdrawals

Card verification is accessible when you initiate a withdrawal using this method.

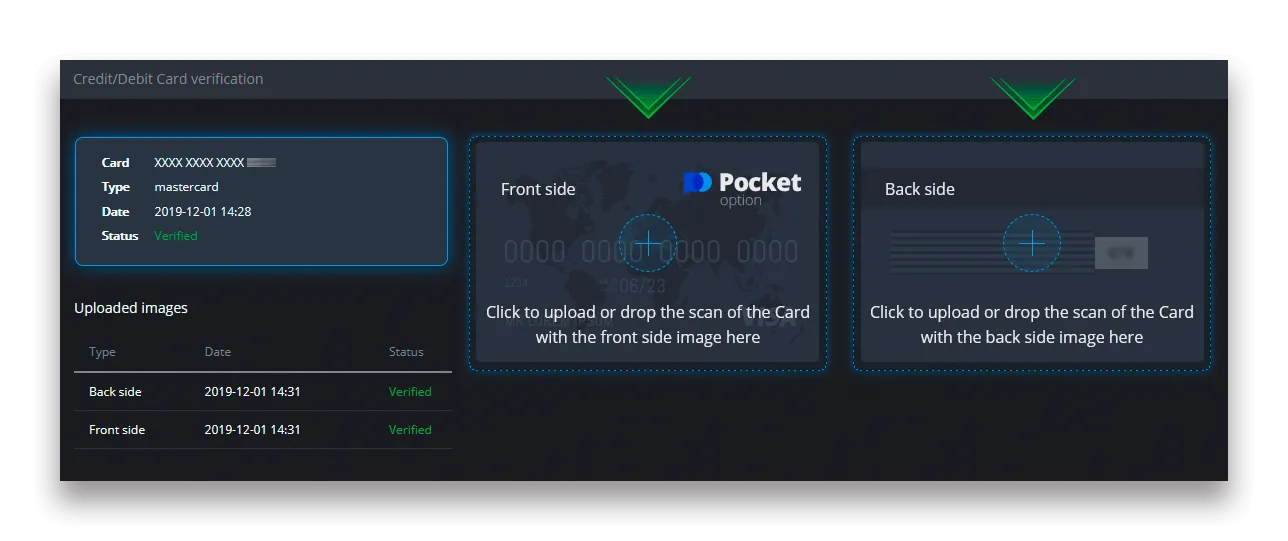

Once the withdrawal request has been initiated, go to your Profile page and locate the “Credit/Debit Card Verification” section.

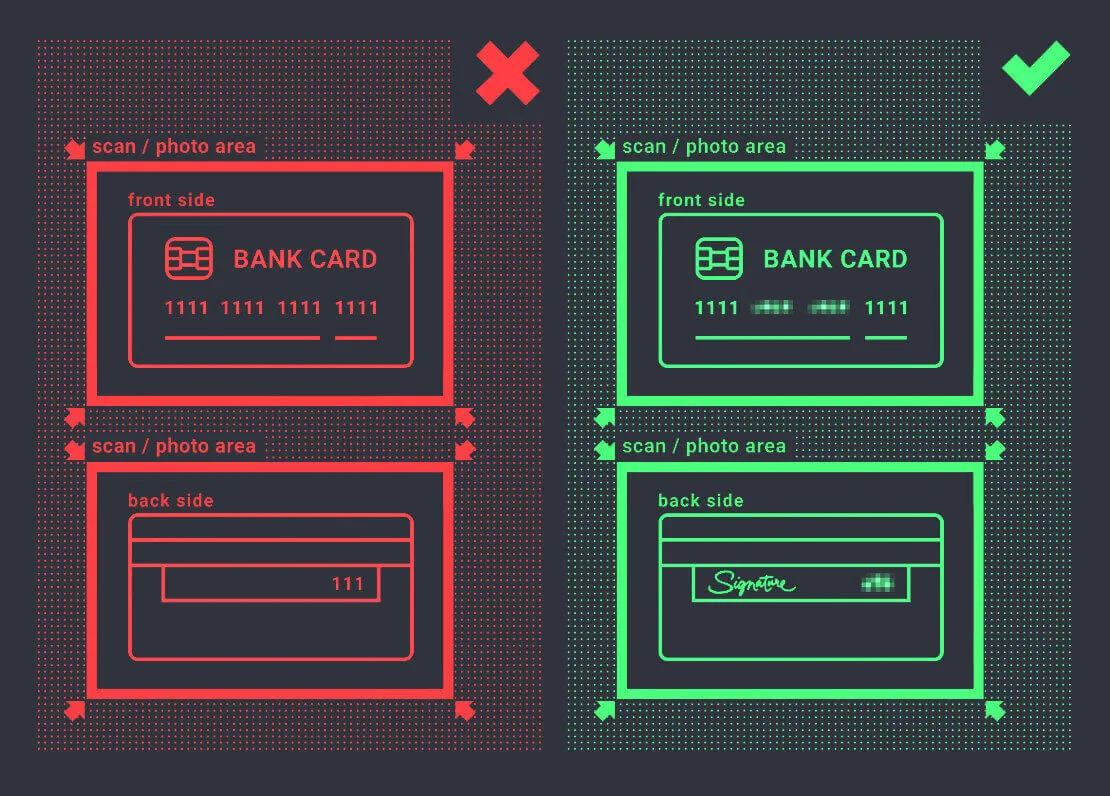

For bank card verification, you are required to upload scanned images (photos) of both the front and back sides of your card to the corresponding sections in your Profile under “Credit/Debit Card Verification.” On the front side, please ensure that all digits are covered except for the first and last 4 digits. On the back of the card, conceal the CVV code, and ensure that the card is signed.

Example:

The verification process will commence once you initiate it. You can utilize the verification request to monitor the progress or contact our support team for assistance.