Paano I-verify ang Inyong Pocket Option Account

Ang pag-verify ng user data ay isang mandatory na proseso na nakahanay sa mga stipulasyon ng KYC (Know Your Customer) policy at mga global na regulasyon laban sa money laundering (Anti Money Laundering).

Sa aming papel bilang broker, dapat naming i-verify ang mga pagkakakilanlan ng user, kumpirmahin ang mga residential address, at i-validate ang mga email address bilang bahagi ng aming proseso ng user identification.

Pag-verify ng Email Address

Pagkatapos ng registration, isang email confirmation ang ipapadala sa inyo mula sa Pocket Option. Sa loob ng email na ito, makikita ninyo ang isang link na dapat i-click upang ma-verify ang inyong email address.

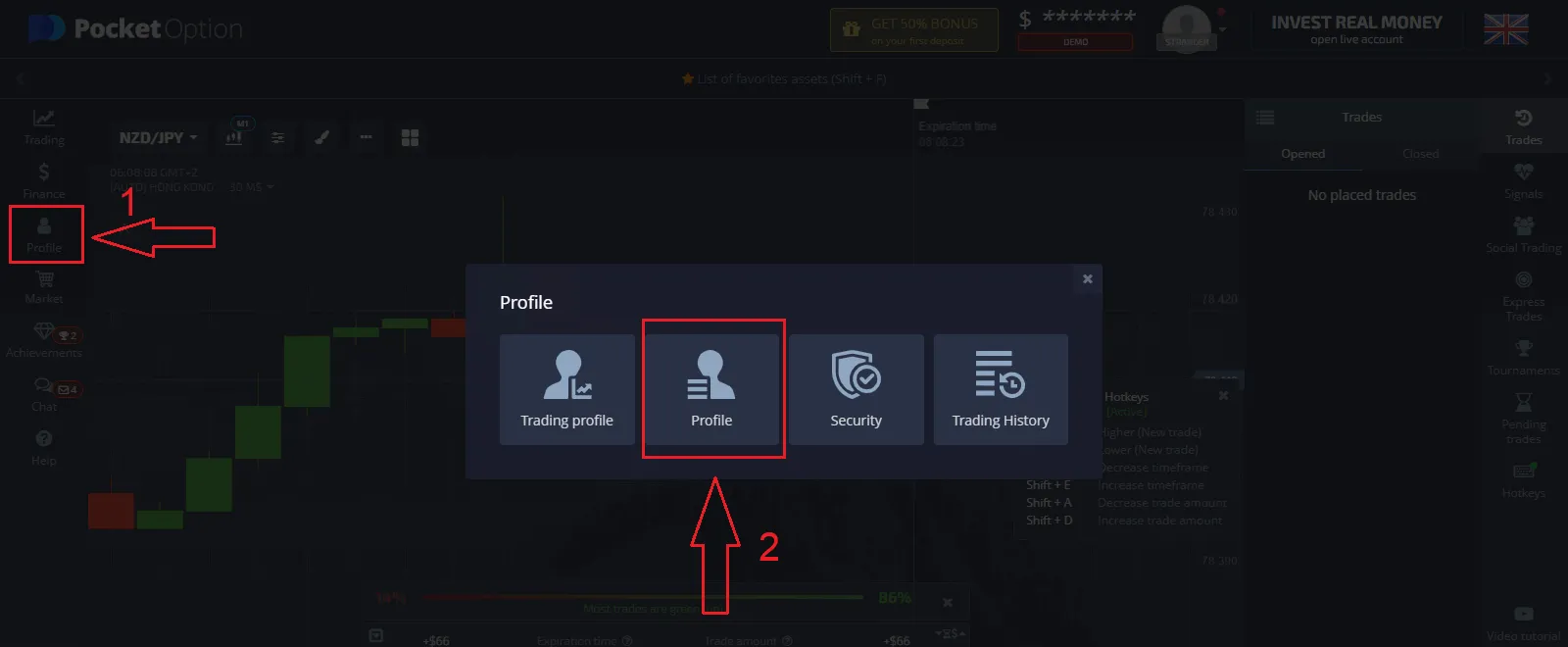

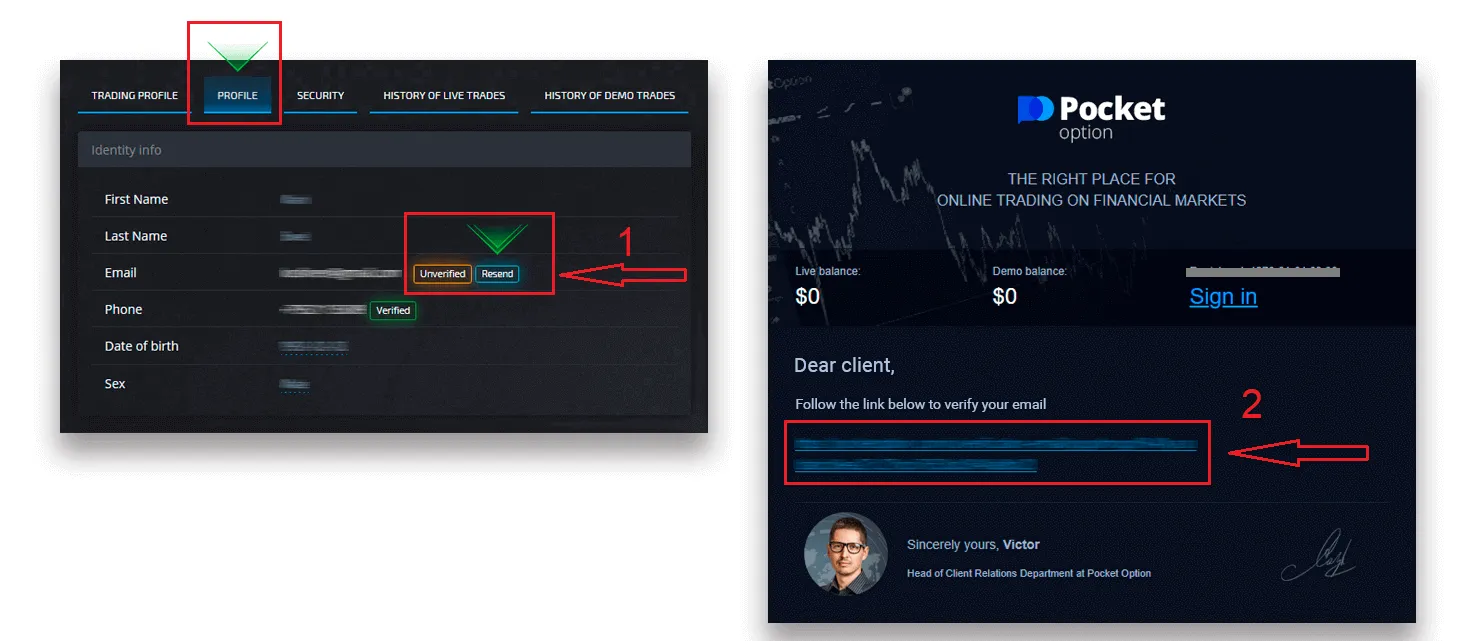

Kung hindi ninyo agad natanggap ang email, mangyaring i-access ang inyong Profile sa pamamagitan ng pag-click sa “Profile” at pagkatapos ay piliin ang “PROFILE.”

Bilang karagdagan, sa loob ng “Identity info” section, hanapin at i-click ang “Resend” button upang simulan ang pagpapadala ng isa pang confirmation email.

Kung hindi ninyo natanggap ang anumang confirmation email mula sa amin, mangyaring magpadala ng mensahe sa support@pocketoptiontrade.com gamit ang email address na ginamit ninyo sa pag-register sa platform, at manu-mano naming kukumpirmahin ang inyong email.

Pag-verify ng Identity

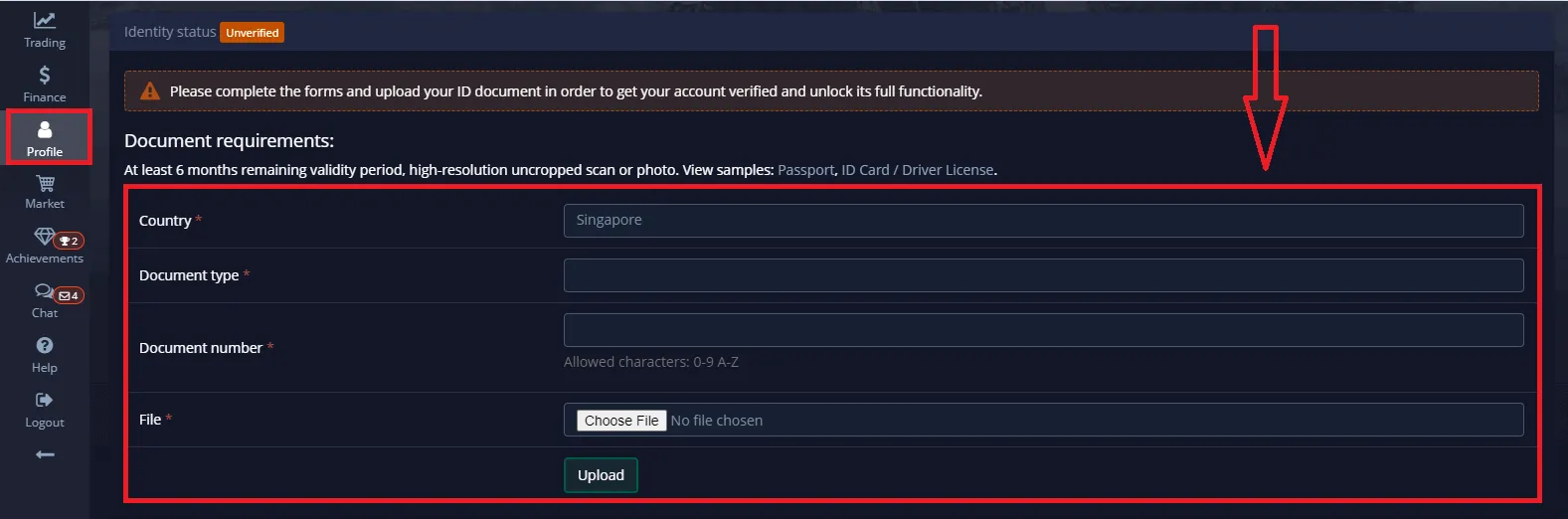

Ang proseso ng pag-verify ay nagsisimula kapag naipasok na ninyo ang inyong Identity at Address details sa inyong Profile at na-upload na ang mga kinakailangang dokumento.

I-access ang Profile page at hanapin ang mga section na may label na Identity Status at Address Status.

Pansin: Mangyaring tandaan, kailangan ninyong ipasok ang lahat ng personal at address information sa Identity status at Address status sections bago mag-upload ng mga dokumento.

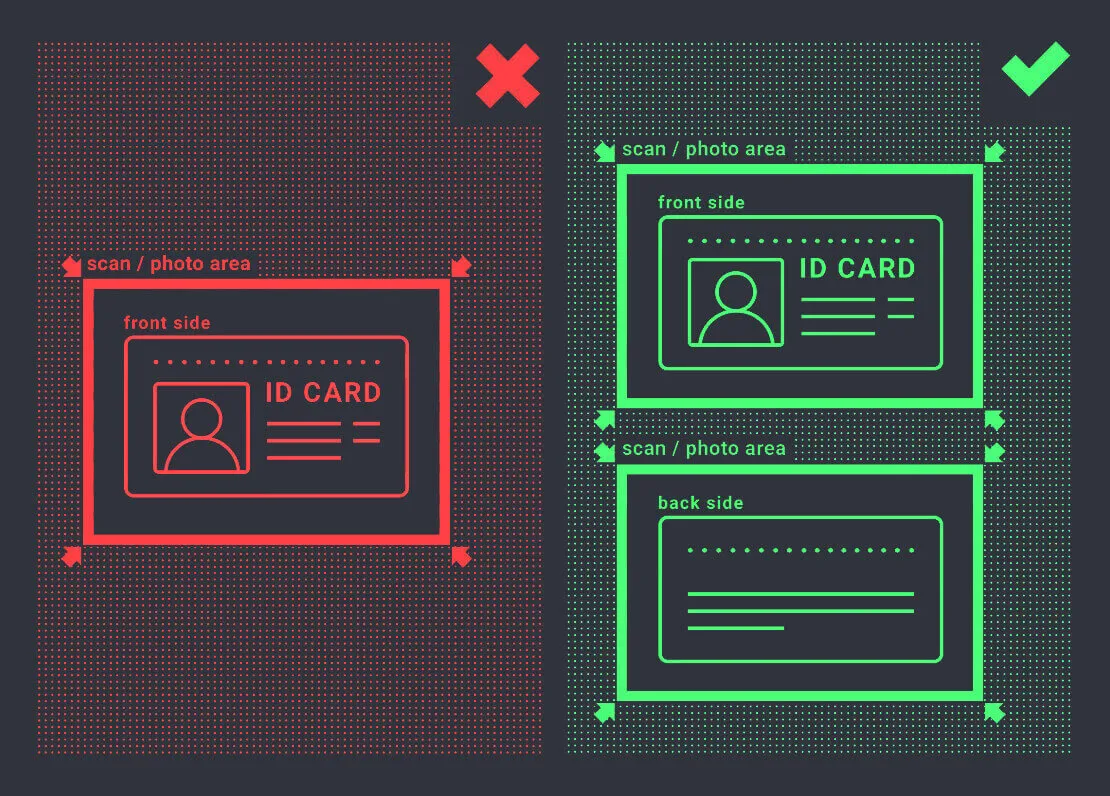

Para sa identity verification, tumatanggap kami ng mga scanned o photographed na larawan ng mga passport, local ID cards (parehong gilid), at driver’s licenses (parehong gilid). Madali ninyong maidagdag ang mga larawang ito sa pamamagitan ng pag-click o pag-drag sa mga kaukulang section ng inyong profile.

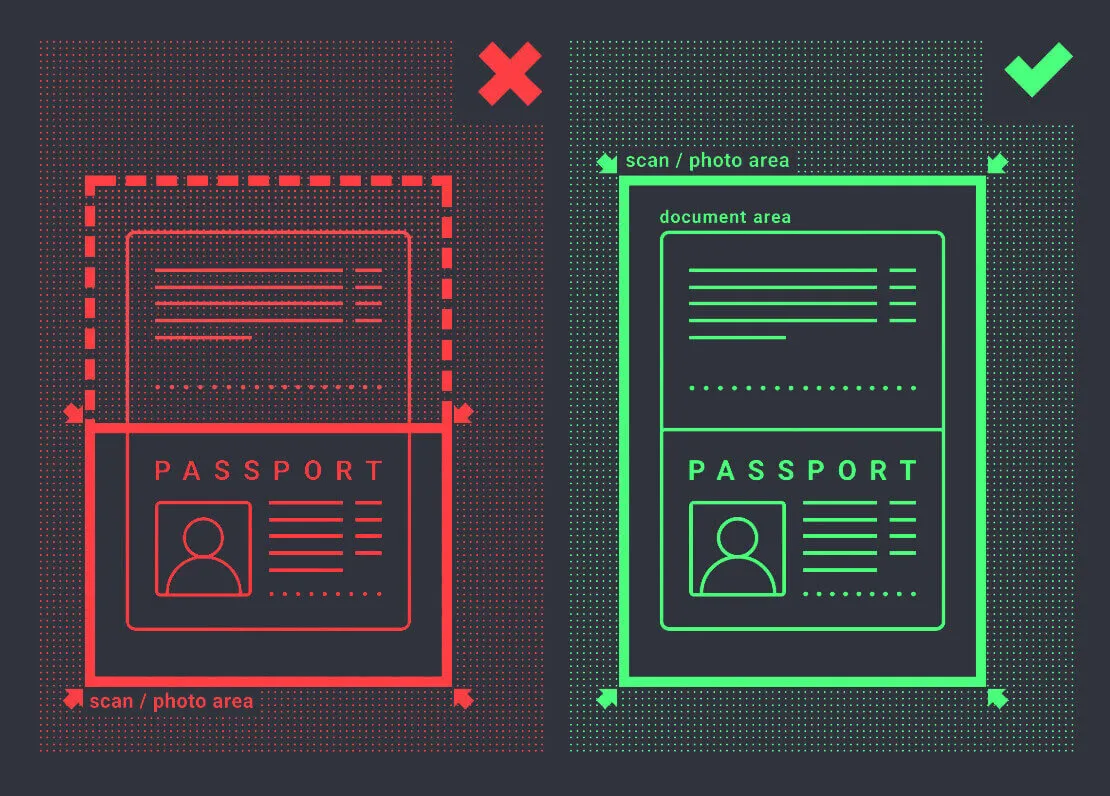

Siguraduhin na ang larawan ng dokumento ay may kulay, hindi na-crop (na may lahat ng mga gilid na ganap na nakikita), at may mataas na resolution (upang matiyak na lahat ng impormasyon ay malinaw na mababasa).

Halimbawa:

Kapag na-upload na ninyo ang mga larawan, isang verification request ang awtomatikong magiging generated. Maaari ninyong i-track ang progress ng inyong verification sa designated support ticket, kung saan ang isa sa aming mga specialist ay magbibigay ng updates at tutulong sa inyo sa proseso.

Pag-verify ng Address

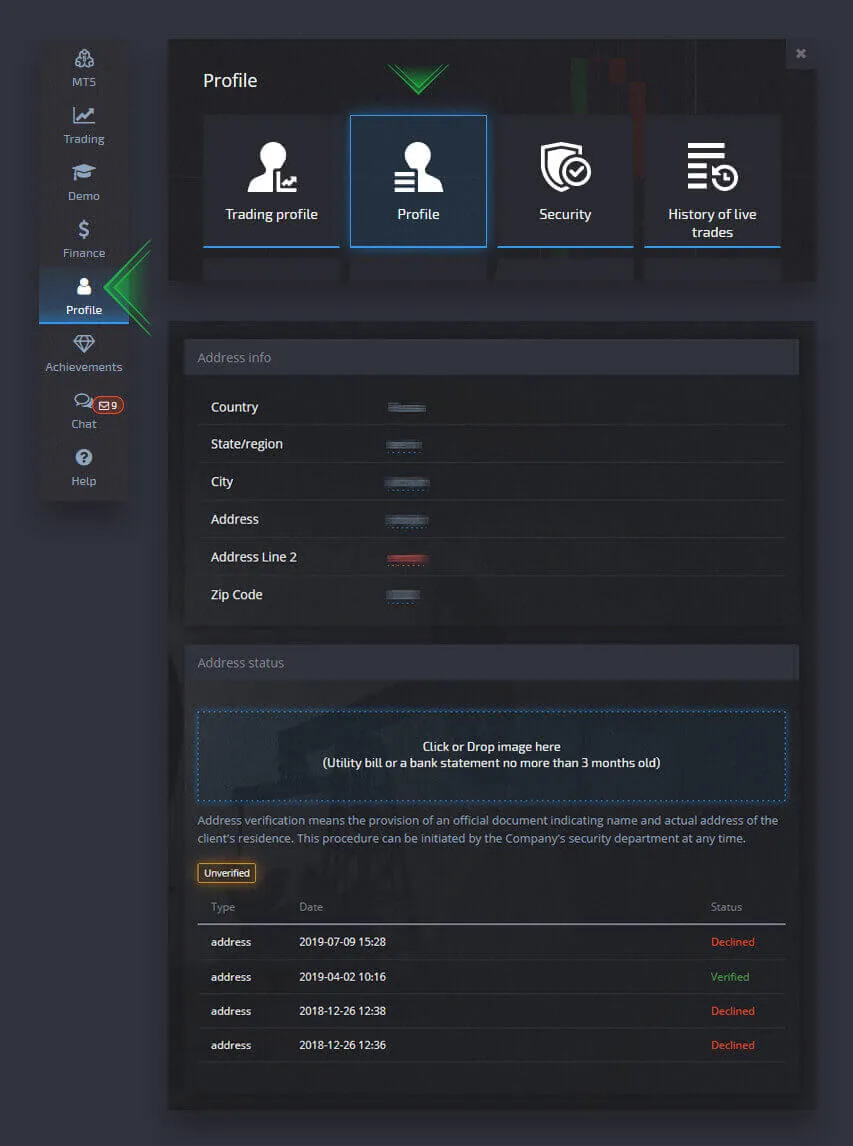

Ang proseso ng pag-verify ay nagsisimula pagkatapos ninyong makumpleto ang Identity at Address sections sa inyong Profile at na-upload na ang mga kinakailangang dokumento.

Upang magsimula, mag-navigate sa inyong Profile page at hanapin ang mga section na may label na “Identity Status” at “Address Status.”

Mangyaring maging aware na mahalagang ipasok ang lahat ng personal at address information sa “Identity Status” at “Address Status” sections bago magpatuloy sa pag-upload ng mga dokumento.

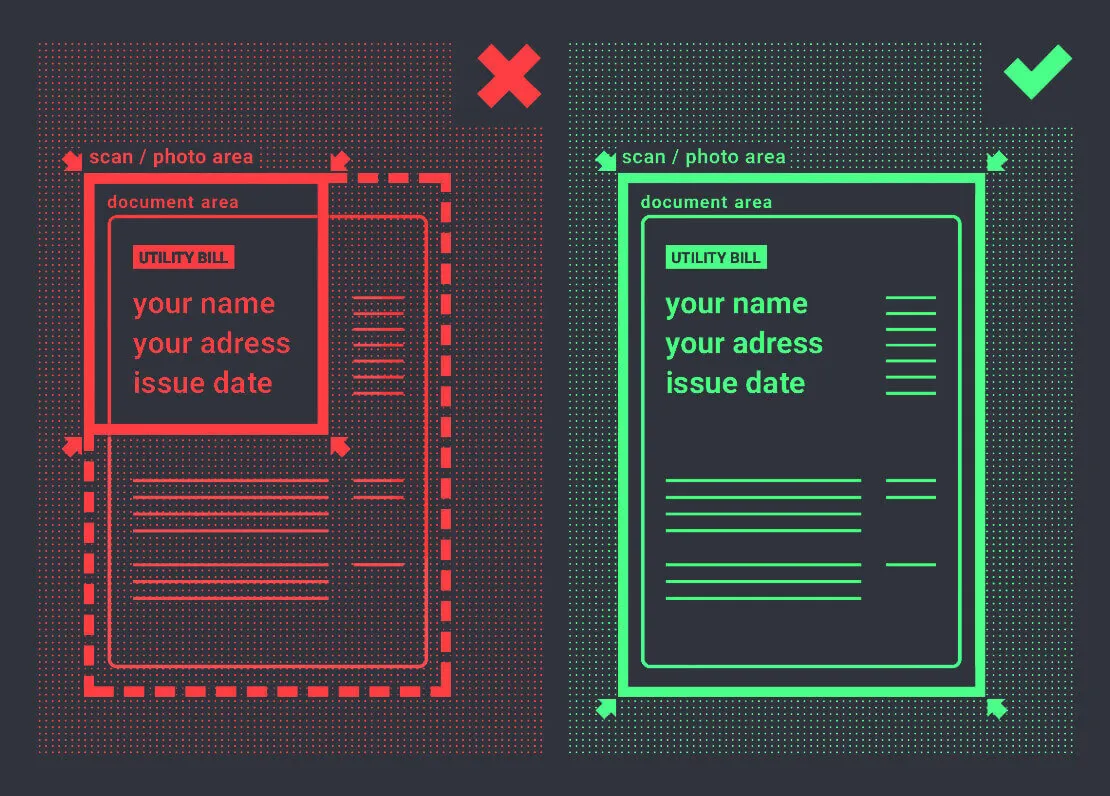

Siguraduhing punan ang lahat ng fields (maliban sa “address line 2,” na optional). Para sa address verification, kailangan namin ng isang paper-issued proof of address document na inisyu sa pangalan ng account holder at nagpapakita ng address na hindi mas matanda sa 3 buwan (mga halimbawa ay kasama ang utility bill, bank statement, o address certificate). Madali ninyong maidagdag ang mga larawan ng dokumentong ito sa pamamagitan ng pag-click o pag-drag sa mga kaukulang section ng inyong profile.

Siguraduhin na ang larawan ng dokumento ay may kulay, high-resolution, at hindi na-crop (lahat ng mga gilid ng dokumento ay dapat na malinaw na nakikita nang walang cropping).

Halimbawa:

Kapag na-upload na ninyo ang mga larawan, isang verification request ang awtomatikong magiging generated. Maaari ninyong i-monitor ang progress ng inyong verification sa designated support ticket, kung saan ang isang specialist ay magbibigay ng updates at assistance.

Pag-verify ng Bank Card

Pamamaraan ng Pag-verify ng Card para sa Withdrawals

Ang card verification ay accessible kapag sinimulan ninyo ang withdrawal gamit ang method na ito.

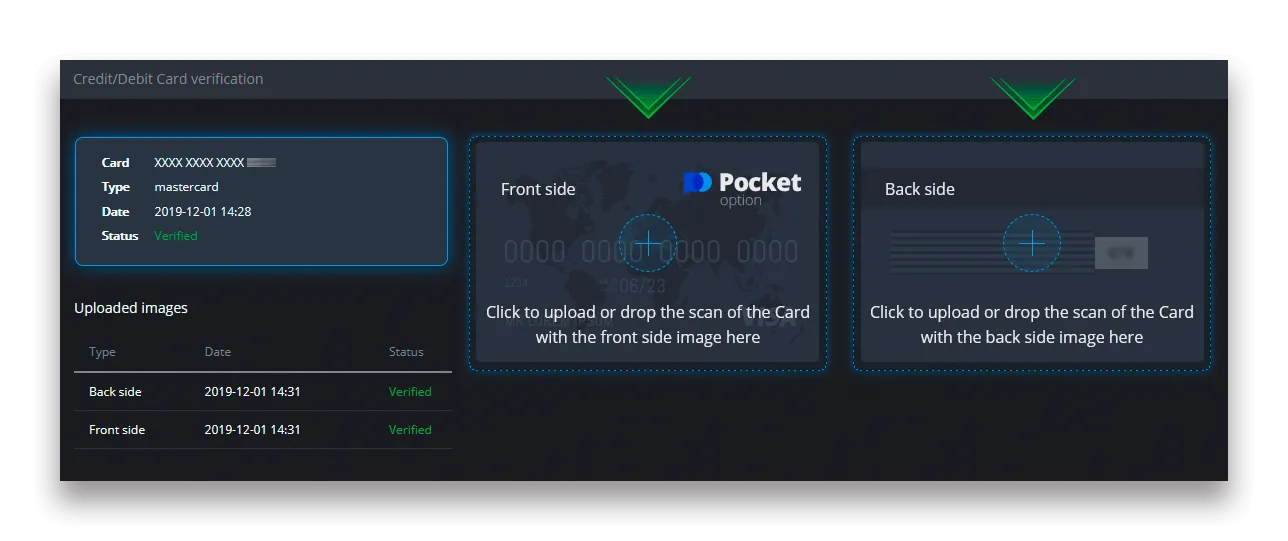

Kapag na-initiate na ang withdrawal request, pumunta sa inyong Profile page at hanapin ang “Credit/Debit Card Verification” section.

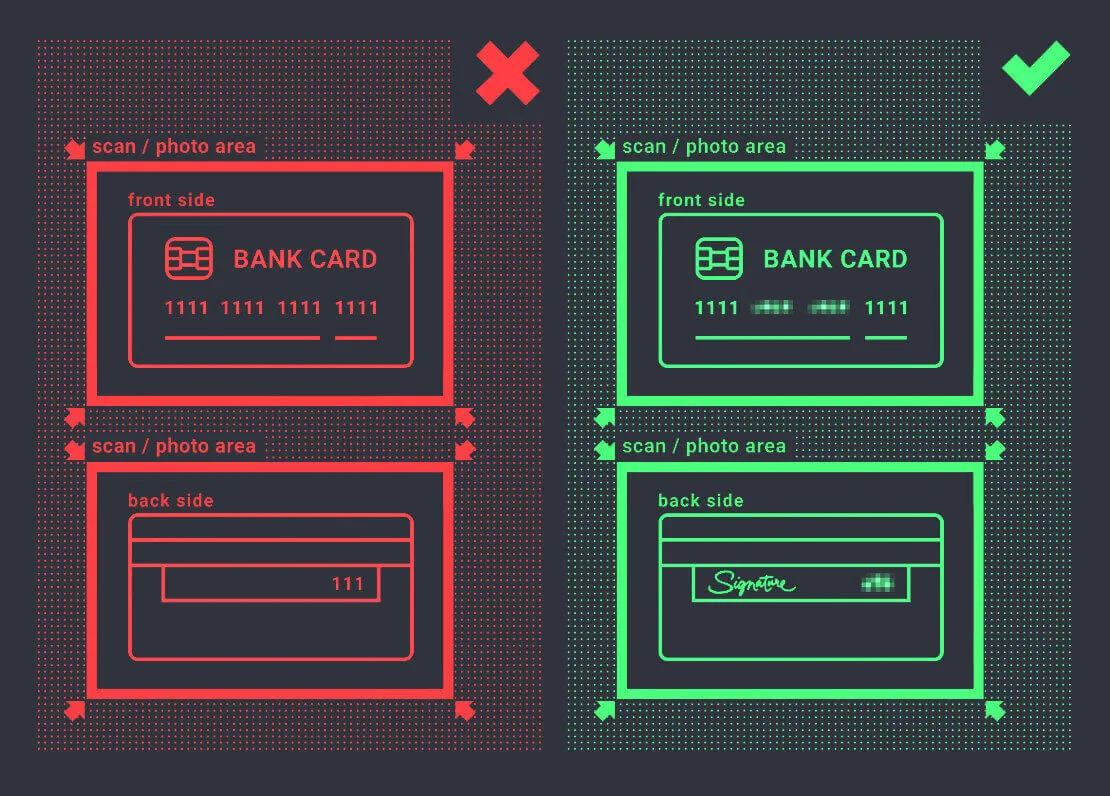

Para sa bank card verification, kailangan ninyong mag-upload ng mga scanned na larawan (mga litrato) ng parehong front at back sides ng inyong card sa mga kaukulang section sa inyong Profile sa ilalim ng “Credit/Debit Card Verification.” Sa front side, mangyaring siguraduhin na lahat ng mga digit ay nakatakip maliban sa unang at huling 4 na digit. Sa likod ng card, itago ang CVV code, at siguraduhin na ang card ay naka-sign.

Halimbawa:

Ang proseso ng pag-verify ay magsisimula kapag na-initiate na ninyo ito. Maaari ninyong gamitin ang verification request upang i-monitor ang progress o makipag-ugnayan sa aming support team para sa assistance.